Bitcoin in Africa: How it’s Challenging a Broken Financial System

Written by

Krista Alvarez

Published on

March 27, 2023

Time reading

3 minutes

With the emergence of new technologies like blockchain and crypto, Bitcoin is positioned as a potentially transformative alternative to the existing financial system in Africa. In December, Block CEO Jack Dorsey and his top brass descended on Accra for the inaugural Africa Bitcoin Conference to talk about Bitcoin in Africa. In this article, we explore how blockchain in Africa is offering an onramp to the financial system for the unbanked and challenging a broken financial system.

The Potential of Bitcoin in Africa

Bitcoin in Africa offers a parallel financial system that doesn’t require intermediaries to approve transactions, making it a vital lifeline for survival in countries where national currencies are no longer a safe store of value, remittances comprise a hefty portion of GDP, and international sanctions complicate connections to the global economy. Companies like Paxful are using Bitcoin to provide a new way of banking for the unbanked in Africa.

Bitcoin challenges a broken financial system that makes moving money expensive and complicated. Commercial bank branch access is limited, especially for people living in remote and rural areas. Digital banking options are also limited, and rampant hyperinflation, widespread government corruption, and capital controls trapping domestic cash in banks can make money stop making sense altogether.

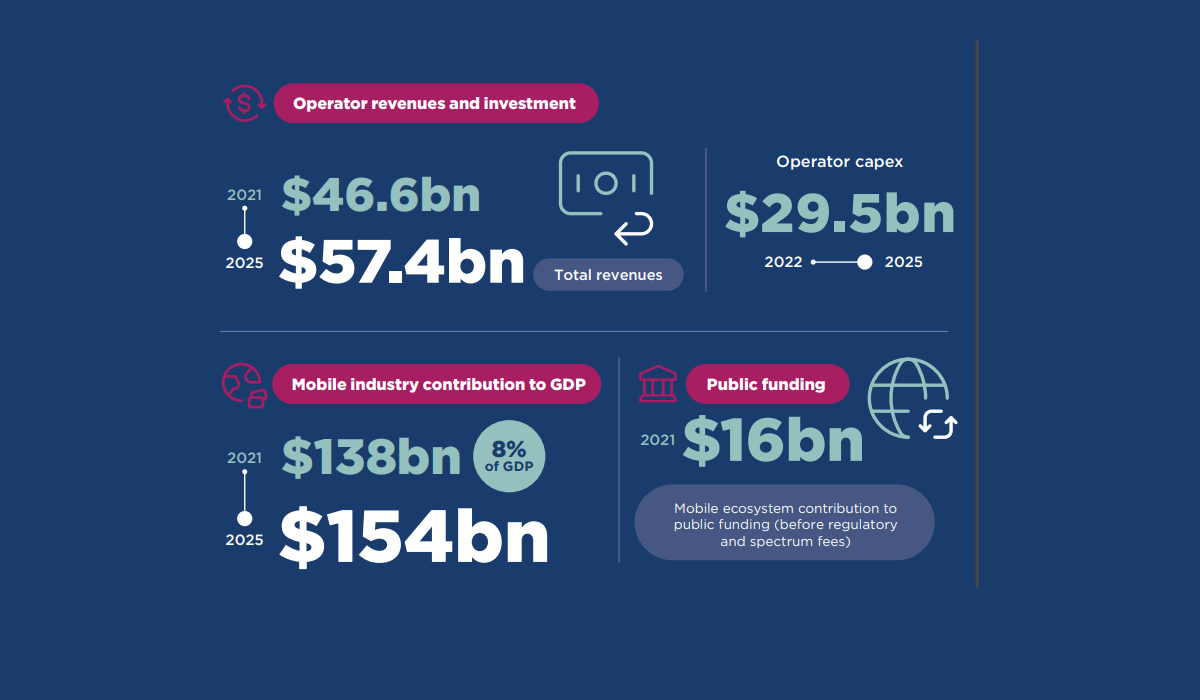

Image credit: gsma.com

Bitcoin as a Solution

Bitcoin in Africa could eliminate intermediaries, allowing citizens to send digital payments directly to one another without relying on credit and without incurring multiple settlement fees along the way. Bitcoin’s decentralized nature and ability to move money instantaneously make it an attractive alternative to traditional banking options. Companies like Western Union and MoneyGram offer an expansive physical network of storefronts around the world designed to move money for the unbanked, but these cash transfers often incur substantial fees. Bitcoin in Africa offers a cheaper and more accessible alternative.

The Challenges of Bitcoin in Africa

Africa’s mobile money transactions rose 39% to more than $700 billion in 2021, but even as adoption proliferates, mobile money users don’t get the perks of legacy banking. Mobile money users don’t earn interest on banked savings, and they don’t build up a credit score based on a history of spending. Interoperability on the continent also remains a major issue with this alternative way of banking.

Bitcoin in Africa is not without its challenges. The regulatory landscape is still evolving, and many African countries are still grappling with how to approach cryptocurrency. Some governments are open to the idea of digital currencies, while others have been hostile. The lack of a clear regulatory framework can create uncertainty for businesses and investors looking to enter the market.

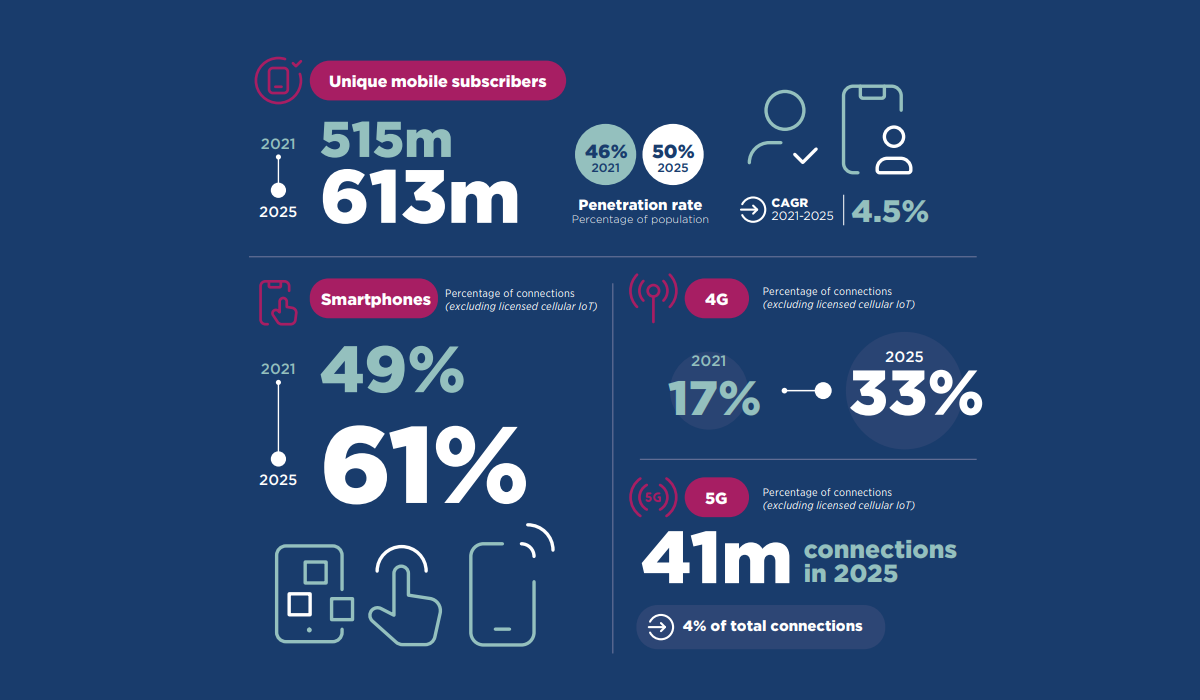

Another challenge is the lack of infrastructure in some parts of the continent. While mobile phone penetration is high in many African countries, access to the internet is still limited in some areas. This can make it difficult for people to use Bitcoin, which relies on an internet connection to function.

Image credit: gsma.com

The Impact of Bitcoin in Africa

Bitcoin is empowering citizens to send digital payments directly to one another, without intermediaries or fees. During the #EndSARS movement in Nigeria, Bitcoin served as a lifeline for protesters whose access to traditional banking was blocked by the government. Bitcoin in Africa offers hope for a better financial future for the unbanked.

The Future of Bitcoin in Africa in 2023

As we move further into 2023, Bitcoin and other cryptocurrencies is expected to continue gaining momentum. It brings financial power to people who would otherwise have none, and it offers a potential solution to a broken financial system.

With the rise of Bitcoin and other cryptocurrencies, we can expect to see more innovation and progress in the financial sector and more opportunities for the unbanked. However, there are still challenges to be faced, such as regulatory uncertainty and limited infrastructure in some areas. Nonetheless, the potential for Bitcoin in Africa to empower citizens and transform the financial landscape of the continent is exciting and full of promise.