Unveiling the Dark Corners of DeFi: Insights from Recent EUROPOL Report

Written by

Krista Alvarez

Published on

September 17, 2023

Time reading

3 minutes

According to the recent EUROPOL report titled “The Other Side of the Coin,” Decentralised finance (DeFi) is at the forefront of financial innovation, promising autonomy, fewer intermediaries, and bolstered security through blockchain technology. Yet, every innovation has its challenges.

The very attributes that make DeFi appealing, such as its decentralization and absence of conventional oversight, also render it susceptible to economic crimes. As the adoption of cryptocurrencies surges, so does their potential misuse.

The report sheds light on the increasing complexities, from sophisticated fraudulent investment tactics to elaborate money laundering schemes, revealing the darker facets of the crypto realm.

The NFT Boom and its Dark Side

Non-fungible tokens (NFTs), which serve as unique digital assets authenticated on a blockchain, have witnessed an explosive growth in recent years. Their uniqueness and the art, music, or even tweets they represent have made them highly sought after.

Their popularity has also attracted nefarious actors. There have been instances where criminals have created and sold counterfeit NFTs, duping unsuspecting buyers. Additionally, the same NFTs are sometimes sold to multiple buyers, and their instantaneous cross-border trading feature makes them an attractive tool for money laundering.

Metaverse: A New Realm of Opportunities and Threats

The concept of the metaverse, a collective virtual shared space created by converging virtually augmented physical reality and interactive digital spaces, is gaining traction. As businesses, educators, and even social communities explore its potential, it’s becoming a hotspot for financial transactions. However, its vastness and relative novelty also mean that it’s a playground for criminals. Reports of fraud, digital theft, and other cybercrimes in the metaverse are becoming more frequent, indicating the challenges that lie ahead in this digital frontier.

The Complex Web of Digital Assets

While law enforcement and regulatory agencies have made significant strides in understanding and monitoring traditional financial transactions, the world of cryptocurrency remains a challenging frontier. The global nature of these transactions, combined with their speed and the anonymity that some coins offer, makes tracking illicit activities a daunting task. To further complicate matters, criminals are constantly evolving their strategies. They’re not just sticking to well-known cryptocurrencies like Bitcoin or Ethereum. Instead, they’re exploring DeFi platforms, using NFTs, and even turning to privacy-centric coins to stay one step ahead of the law.

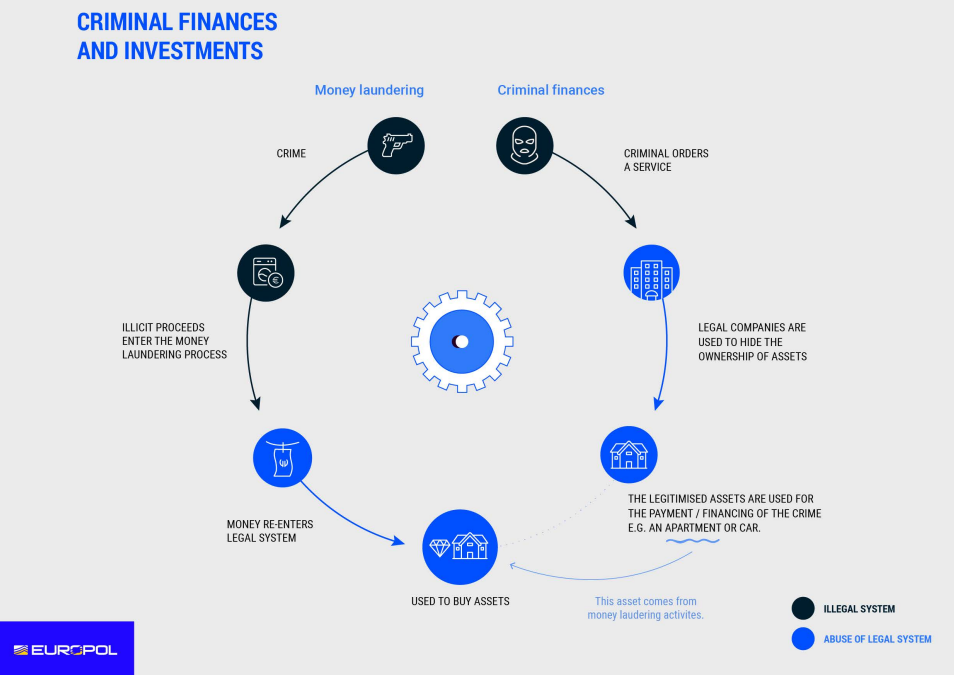

Cryptocurrency and the Intricacies of Money Laundering

One of the sophisticated techniques employed by criminals in the crypto realm is “chain hopping.” It involves moving illicit funds across a series of cryptocurrencies. By doing so, often through exchanges with lax regulations, they create a convoluted money trail that’s hard to trace. Adding to the complexity, some employ cryptocurrency mixers or tumblers. These services jumble up transactions, breaking the direct link between the source and the destination, making the original funds almost untraceable.

Blurring the Lines: When Romance Meets Fraud

In a disturbing trend, cryptocurrency-related frauds are intertwining with other types of scams, leading to more significant financial and emotional damage. Imagine a scenario where an individual is slowly drawn into a romantic online relationship. Over time, as trust is built, they’re persuaded to invest their savings in fraudulent cryptocurrency trading platforms. The result? Devastating financial losses. Another emerging scam is liquidity mining fraud, where crypto holders interested in earning passive income are targeted.

A Case that Shook the Crypto World

A recent investigation brought to light a massive scam that exploited the social media platform ‘Vitae.co’ and the ‘Vitaetoken.io’ website. This elaborate Ponzi scheme managed to ensnare a staggering 223,000 individuals spanning 177 countries. The masterminds behind this operation weren’t small-time crooks but included individuals with significant resources. The subsequent crackdown led to the seizure of assets worth over EUR 2.5 million, including cash, cryptocurrencies, and luxury vehicles.

Navigating the Complex Landscape of DeFi’s Risks and Rewards

The rapid advancements in the DeFi and crypto landscape bring forth a mix of excitement and caution. While the potential for reshaping the financial world is immense, the challenges are equally significant. It underscores the urgent need for increased awareness, robust regulatory frameworks, and international cooperation to ensure the safety and integrity of these platforms.

Source: europol.europa.eu