The value of Bitcoin has surged above $24,000, prompting investors to speculate about the possibility of a new bull market. Following the all-time high of Bitcoin in December 2017, the cryptocurrency has been trying to recover its previous position after a major decline. However, recent developments such as corporate investments and institutional adoption have led to a sharp increase in Bitcoin’s value, giving rise to expectations of a potential new bull market.

The establishment of the Bank of New York Mellon’s digital asset unit has been regarded as a vital step in the evolution of cryptocurrencies, demonstrating a shift in attitude towards the use of blockchain technology and digital assets. It is also anticipated to facilitate the adoption of cryptocurrencies by institutional investors and attract more mainstream interest in the industry.

Major Corporations’ Adoption of Cryptocurrencies Boost Bitcoin Value

In addition to the Bank of New York Mellon’s move, the growing adoption of cryptocurrencies by major corporations, such as Paypal, Mastercard, and Visa, has contributed to the recent surge in the value of Bitcoin. The increasing number of companies accepting Bitcoin as a form of payment, combined with the heightened demand from institutional investors, is expected to drive further growth in the cryptocurrency market.

Despite the increasing demand for digital assets, the cryptocurrency market remains highly volatile, and future price predictions should be taken with caution. While some analysts remain optimistic, others have warned of a potential market correction in the coming months, with fluctuations in Bitcoin’s value likely to persist. Nevertheless, the growing institutional adoption and interest in cryptocurrencies signal a continued shift towards a digital economy.

Crypto Market Surges on Institutional Adoption and Strong Retail Sales

Today, the global cryptocurrency market has experienced a notable surge, driven mainly by increasing institutional adoption and interest from major corporations. Additionally, robust US retail sales data has instilled confidence in investors, as it is viewed as a positive sign for corporate earnings rather than a cause for concern over potential interest rate hikes.

In January 2023, the launch of the non-fungible tokens (NFTs) protocol Ordinals has resulted in a significant increase in the size of Bitcoin blocks, with the average block size reaching 2.5 gigabytes (GB) for the first time since the cryptocurrency’s inception in 2009. This development has contributed to the current upward trend in the cryptocurrency market.

As of the time of writing, the global crypto market cap has hit a new record of $1.11 trillion, representing an 8.55 percent increase in the past 24 hours.

Bitcoin’s Average Block Size Reaches Record High with NFTs Protocol

The average block size of Bitcoin has recently achieved a new record of over 2.5 gigabytes (MB), surpassing the previous high since the cryptocurrency’s inception in 2009. This achievement is attributed to the implementation of the non-fungible tokens (NFTs) protocol Ordinals, which was developed by software engineer Casey Rodarmor and launched in January 2023.

Since its launch in January 2023, the implementation of the non-fungible tokens (NFTs) protocol Ordinals has enabled users on the Bitcoin network to create various digital artifacts, such as JPEG photos, PDF documents, audio files, and video files. As a result, the average block size has increased by over 2 MB in the weeks following the protocol’s introduction, signifying a significant expansion of Bitcoin’s network activity.

This advancement marks a noteworthy milestone in the growth of Bitcoin, as it has the potential to enhance network activity without relying solely on the conventional transfer of cash volume for financial purposes.

US Dollar Weakening Amidst Uncertainty Over Interest Rates and Labor Market

After reaching a six-week peak of 104.11 in the prior session, the US dollar has recently experienced a weakening trend. Following significant gains earlier in the week, profit-taking has led to a decrease in the value of the US dollar against a basket of currencies.

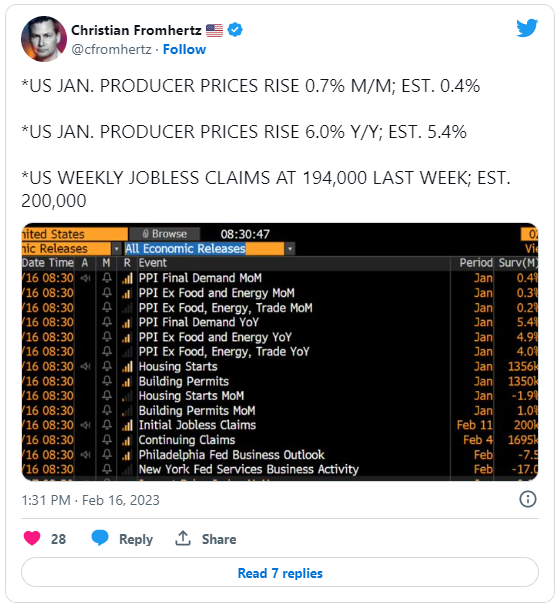

Both the dollar index and dollar index futures have declined by approximately 0.2%. Uncertainty around the potential peak of interest rates for the current year, despite positive signs of growth in the US labor market and inflation, has made traders more cautious in taking risks on Asian currencies. This has resulted in a more conservative trading approach among traders.

On Thursday, the US Department of Labor issued an update revealing that there were 194,000 new filings for unemployment benefits during the week ending on February 11th. This figure represents a slight increase from the previous week’s count of 190,000, and it is consistent with the 195,000 claims reported during the preceding week.

According to the report, the advance seasonally adjusted insured unemployment rate was recorded at 1.2%. Additionally, the four-week moving average, which is calculated as the mean of the previous four weeks’ data, was reported as 189,500, representing a slight increase of 500 from the adjusted average of the previous week.

The report also notes that the seasonally adjusted number of employed individuals in the US for the past week was recorded at 156,000, representing a notable increase from the revised figure of 146,000 reported in the prior week. These data provide insight into the current state of the US labor market and the ongoing fluctuations in employment rates. However, it’s important to note that these figures may be subject to revisions in the future, and longer-term trends should be considered for a more comprehensive view of the labor market’s performance.

Bitcoin Price Surges as Bulls Break Key Resistance Level

The current live price of Bitcoin is presently $22,974, and it has registered a trading volume of $25 billion over the past 24 hours. During this period, the value of Bitcoin has risen by nearly 4%. It is noteworthy that Bitcoin remains at the top of the CoinMarketCap rankings, with a live market capitalization of $443 billion.

Bitcoin has successfully surpassed a significant double top resistance level of $24,300. With the current candles closing above this level, there is a higher possibility of a bullish trend continuation in BTC. The immediate resistance levels for Bitcoin are $25,450 and $26,000, and the market will be closely monitored for further developments in the coming days. These levels are essential indicators of the cryptocurrency’s short-term performance and could signal further growth for the asset in the near future.

Bearish Breakout Threatens $22.5K Support, But Bullish Factors Persist

Should there be a bearish breakout beneath the $24,300 level, the price of Bitcoin could decline towards the $22,500 level, supported by an upward channel. It’s worth noting, though, that the RSI and MACD indicators are presently in the buying zone, and Bitcoin has formed an upward channel. These factors suggest a high likelihood of continued bullish trading above the $24,300 level.

With the potential for additional bullish momentum, market participants will likely pay close attention to the price movement of Bitcoin over the next few days. While the upward channel and favorable indicators are encouraging signs for the cryptocurrency’s short-term performance, the market can be unpredictable, and unexpected events could trigger significant price swings.

Source: https://cryptonews.com/news/bitcoin-price-prediction-as-btc-blasts-past-24000-is-new-bull-market-starting.htm