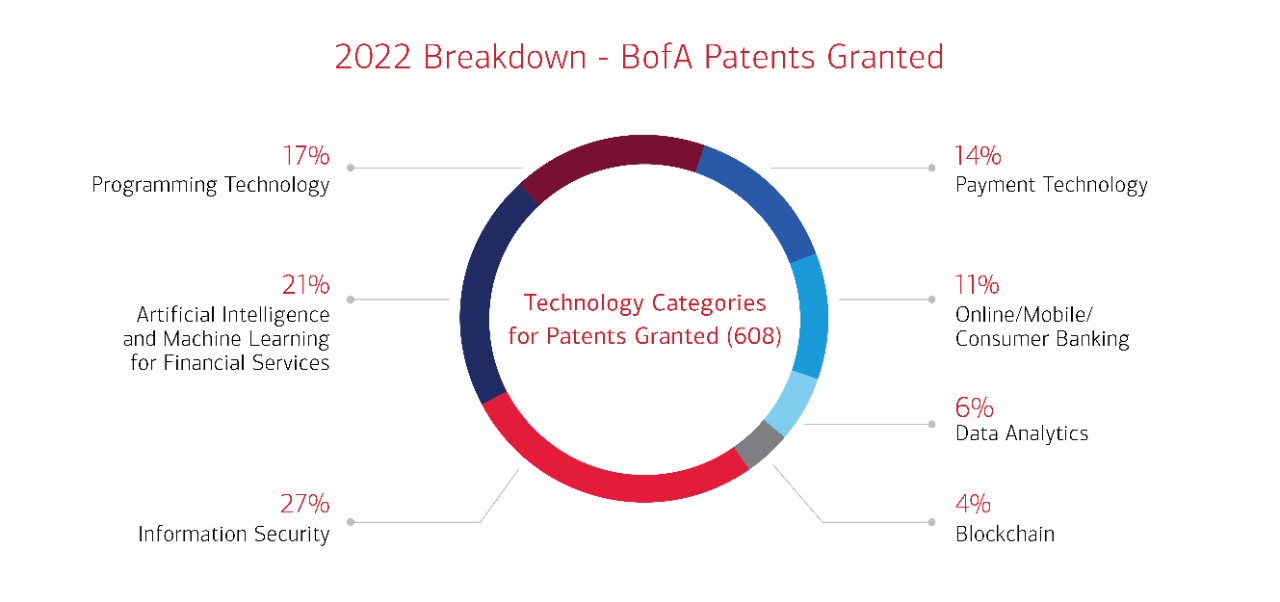

Bank of America has experienced a surge in granted patents, reaching 608 in 2022. This 19% increase over the previous year is particularly significant considering the United States Patent and Trademark Office issued 1% fewer patents overall in 2022. Blockchain technology, artificial intelligence, Web3, and machine learning have all played crucial roles in driving this innovation.

Incorporating artificial intelligence into their portfolio, Bank of America has developed solutions for enhancing customer experience, fraud detection, and process optimization. Meanwhile, the bank’s exploration of blockchain framework, including its applications in Bitcoin and other digital assets, has led to groundbreaking advancements in secure and efficient payment systems.

As the Web3 ecosystem continues to grow, Bank of America is embracing the decentralized nature of this new era, integrating the potential of non-fungible tokens (NFTs) into their services. This includes leveraging NFTs for digital asset management, securing intellectual property rights, and fostering new revenue streams.

Artificial Intelligence and Machine Learning Advancements

Bank of America’s investment in artificial intelligence and machine learning has yielded substantial results. These technologies are being applied to improve customer service, enhance fraud detection, and optimize internal processes. By leveraging AI and ML, the bank is empowering its customers to live better financial lives.

Information Security: Protecting Client Data and Transactions

With an increasing number of digital transactions, information security has become a top priority for Bank of America. The bank has developed innovative, patented solutions to ensure the security of client data and financial transactions. By focusing on information security, the bank is fostering trust and confidence in its digital services.

Image Credit: bankofamerica.com

Revolutionizing Payments with Blockchain

Bank of America’s exploration of blockchain technology has allowed them to create groundbreaking solutions in the payments sector. Blockchain’s decentralized nature, transparency, and security are being harnessed to develop faster, more efficient, and secure payment systems. The bank’s innovations in this area are revolutionizing the way transactions are conducted and recorded, streamlining the customer experience and reducing costs.

Mobile Banking and the Future of Financial Services

The rise of mobile banking has been a game-changer for the financial industry, and Bank of America is at the forefront of this transformation. The bank’s patents in this area include solutions that enhance user experience, increase accessibility, and ensure the security of mobile banking transactions. By staying ahead of the curve in mobile banking, Bank of America is shaping the future of financial services.

The Power of a Diverse Workforce: Driving Innovation

A key factor behind Bank of America’s success in patent growth is its diverse workforce. With over 6,700 inventors from 42 states and 14 countries, the bank’s diverse talent pool is instrumental in driving innovation. Moreover, 26% of the bank’s inventors are women, significantly higher than the global average of 17%. This diversity contributes to a broader range of perspectives, ultimately resulting in more innovative and effective solutions.

Image Credit: bankofamerica.com

Fostering a Culture of Innovation and Inclusivity

Bank of America has cultivated a culture of innovation that encourages every employee to contribute ideas and solutions. Unlike other organizations that rely on specialized innovation labs or R&D groups, the bank empowers all teammates to innovate and patent their ideas. This inclusive approach fosters a collaborative and dynamic environment, driving the development of client-focused solutions.

Bank of America’s Commitment to a Better Financial Future

Bank of America’s record-breaking patent growth demonstrates the bank’s commitment to innovation and progress in the financial industry. By investing in cutting-edge technologies like blockchain, artificial intelligence, and information security, and by embracing a diverse and inclusive workforce, Bank of America is poised to lead the way in shaping the future of financial services. This dedication to innovation ensures that the bank continues to offer its clients secure, efficient, and personalized solutions, enabling them to achieve their financial goals.

The Future of US Banking: A Blockchain Perspective in 2023

As we move further into 2023, the future of US banking is increasingly intertwined with the potential of blockchain technology. Financial institutions like Bank of America are paving the way for widespread adoption of blockchain, transforming the industry and setting new standards for efficiency, transparency, and security. As more banks begin to explore and implement blockchain-based solutions, we can expect a paradigm shift in the way financial services are provided and experienced.

In the coming year, we may see the emergence of new blockchain-powered financial products and services, including digital asset trading, decentralized finance (DeFi) platforms, and tokenization of traditional assets like real estate and art. Banks may also leverage blockchain technology to enhance their existing services, such as streamlining cross-border transactions, automating compliance and regulatory reporting, and improving the security of digital identity management.